Where Should You be Investing in Fix and Flip Properties?

Real estate investors have seen increased activity – and profits – in some of the nation’s most popular fix and flip markets.

In 2021, fix and flip proved to be very profitable for real estate investors. ATTOM’s Year-End 2021 U.S. Home Flipping Report showed that the number of single-family homes and condos flipped in 2021 was up 26% from 2020,reaching the highest point since 2006.

The report also stated that the percentage of house flips increased from 2020 to 2021 in 47% of U.S. metro areas, with considerable profit increases in cities like Amarillo, TX; Charlottesville, VA; and Knoxville, TN.

As competition for real estate remains fierce, it’s more important than ever for investors to do the proper due diligence before choosing a market for your next fix and flip investment.

If you’re an active real estate investor, check out these cities that have become some of the best fix and flip markets in the nation due to roaring demand and stable profits.

Dallas, TX

Q4 2021 Home Flips: 2,175

Q4 2021 Median Purchase Price: $269,500

Q4 2021 Flipped Price: $314,900

Q4 2021 Flipping Gross Profit: $45,400

The Dallas metroplex – comprised of Dallas, Fort Worth, and Arlington, Texas – tops US metros in incredible real estate investment opportunities this year, specifically when it comes to fix and flip investments.

Investors looking to expand or break into the Dallas rental market need to know that new construction is the way to do it. Construction permits increased 41% between 2020 and 2021, with nearly 5% of the new home construction in Dallas being built for SFR and multifamily rentals.

Single-family home construction permits are increasing, but notably, new construction in the multifamily housing market has shown tremendous growth and may provide an investment opportunity unique to this market.

With the surge of single-family, multifamily, and fix and flip activity, investors searching for hard money lenders in Dallas, TX should focus their sights on private lenders like Lima One that offer competitive fix and flip funding so they can move quickly when they find an investment opportunity in Texas.

Denver, CO

Q4 2021 Home Flips: 1,678

Q4 2021 Median Purchase Price: $139,500

Q4 2021 Flipped Price: $205,000

Q4 2021 Flipping Gross Profit: $65,500

Denver’s real estate market has been hugely popular among top real estate investors for several years, which is a major reason it annually ranks among the hottest cities in the U.S. for housing growth.

Even during the pandemic, Denver attracted major corporations such as Healthpeak Properties Inc. and ModivCare, as well as tech companies trading the bustle of Silicon Valley for the mountain ranges of Colorado.

Denver has grown exponentially over the past seven years. It’s one of the fastest-growing cities in the country and was named by US News & World Report as one of the best places to live in America in 2019, second only to Austin, Texas.

As Denver’s tech segment and population grow, demand for remodeled homes also grows. Fix and flip projects can earn a high ROI in Denver due to the competitive homebuying market and the availability of higher paying jobs. In addition, flipped homes in this market typically sell within two months, providing a fast profit for investors.

Pittsburgh, PA

Q4 2021 Home Flips: 371

Q4 2021 Median Purchase Price: $90,000

Q4 2021 Flipped Price: $160,000

Q4 2021 Flipping Gross Profit: $70,000

Known as Steel City, Pittsburgh has quickly become one of the hottest places in Pennsylvania to live because of its strong and steady real estate market. Investors can expect to find cheap properties here that can generate great profits.

The fierce demand in the Pittsburgh real estate market is slowing down, creating potential opportunity for real estate investors. Local real estate experts believe there is less competition because many buyers are putting their plans on hold.

WalletHub ranked Pittsburgh as one of the top 50 U.S. cities for renters. Pittsburgh consistently has high rating for activity in the rental market, affordability, and quality of life – all factors real estate investors look for.

Investors looking for cash-flowing real estate to hold for the long term may find that Pittsburgh is the perfect place to buy and hold rental property. Median home values are currently $234,320 (an increase of nearly 15% from 2021) and have risen by $82,000 over the past five years. Still, the median price is low enough that investors can find properties to flip at a profit.

New Orleans, LA

Q4 2021 Home Flips: 257

Q4 2021 Median Purchase Price: $147,450

Q4 2021 Flipped Price: $220,000

Q4 2021 Flipping Gross Profit: $72,550

There is a high demand for rental properties in New Orleans. One of the lasting effects of Hurricane Katrina was the destruction of affordable properties located in the flood plain. Many New Orleans residents were forced to move because they couldn’t rebuild below sea level.

Some residents left altogether, while others returned to the city within a year or so. Returning residents and Hispanic immigrants working in the city’s tourism industry created a high demand for rental properties in New Orleans.

The French Quarter, Mardi Gras, and Bourbon Street are just a few of the attractions that bring people to New Orleans, creating a great market for investors interested in short-term rental options. Investors considering New Orleans should note that the city passed laws legalizing short-term rentals like Airbnb.

New Orleans offers a lot of promise for fix and flip investors because of the types of housing found in the city. Duplexes, homes converted to apartments, and small apartment buildings are prevalent in New Orleans, accounting for roughly 26% of the city’s housing options.

In Q4 2021, investors purchased properties for $147,450 and sold the completed flips for $220,000 — a $72,000 profit. That ROI is one reason investors may decide that New Orleans is a house flipping market to keep their eye on this year.

Greensboro, NC

Q4 2021 Home Flips: 375

Q4 2021 Median Purchase Price: $147,000

Q4 2021 Flipped Price: $209,000

Q4 2021 Flipping Gross Profit: $62,000

Rents and housing prices are on the rise in Greensboro, creating the potential for increased yields for buy and hold investors interested in investing in the city’s market.

Greensboro is part of the Piedmont Triad in central North Carolina. It’s small enough for people to know their neighbors, yet large enough to be home to a thriving economy. Numerous corporate headquarters and a stable job market make Greensboro a great place for both workers and business.

WalletHub ranked Greensboro as one of the best cities for renters based on the city’s rental market activity, affordability, and quality of life – factors also important to investors. Nearly 30% of the population of Greensboro is between the ages of 20 and 39, a key age group that traditionally prefers to rent rather than own where they live.

The Greensboro fix and flip market is one of the best in the U.S. for investors looking to invest in real estate under $200,000. During Q4 2021, investors purchased homes to flip for $147,000 before selling the newly flipped homes for $209,000 – making a $62,000 profit.

Fix and flip investors can remodel homes in Greensboro for a minimum of $20,000, and homes sell in about three months. With a growing real estate market, Greensboro is among the best places to flip houses in North Carolina.

Fix and Flip Financing

Finding the right location is half the battle for fix and flip investors. When investors know the best places to flip houses based on initial purchase costs, renovation charges, and turnaround times, they can be confident that they will turn a profit.

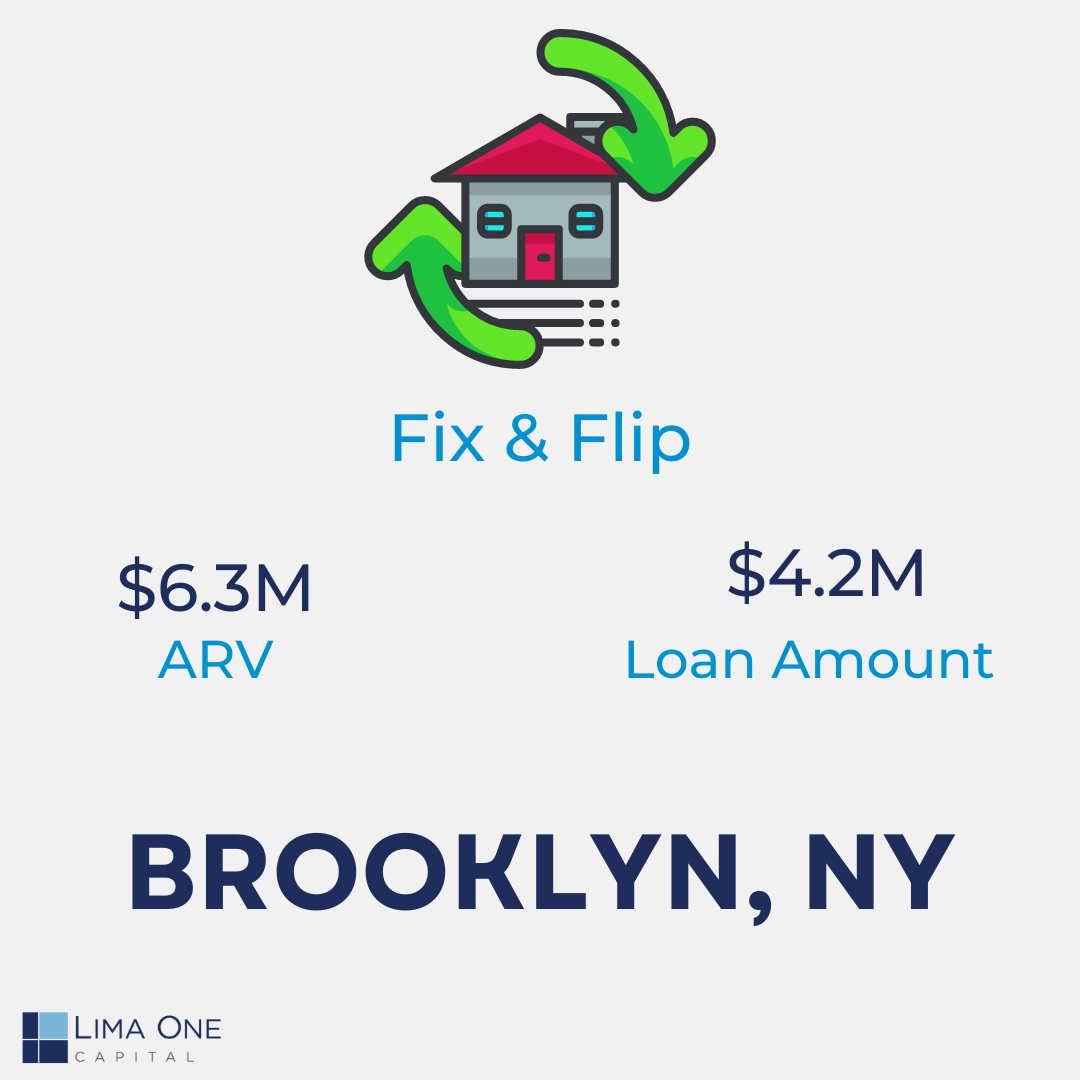

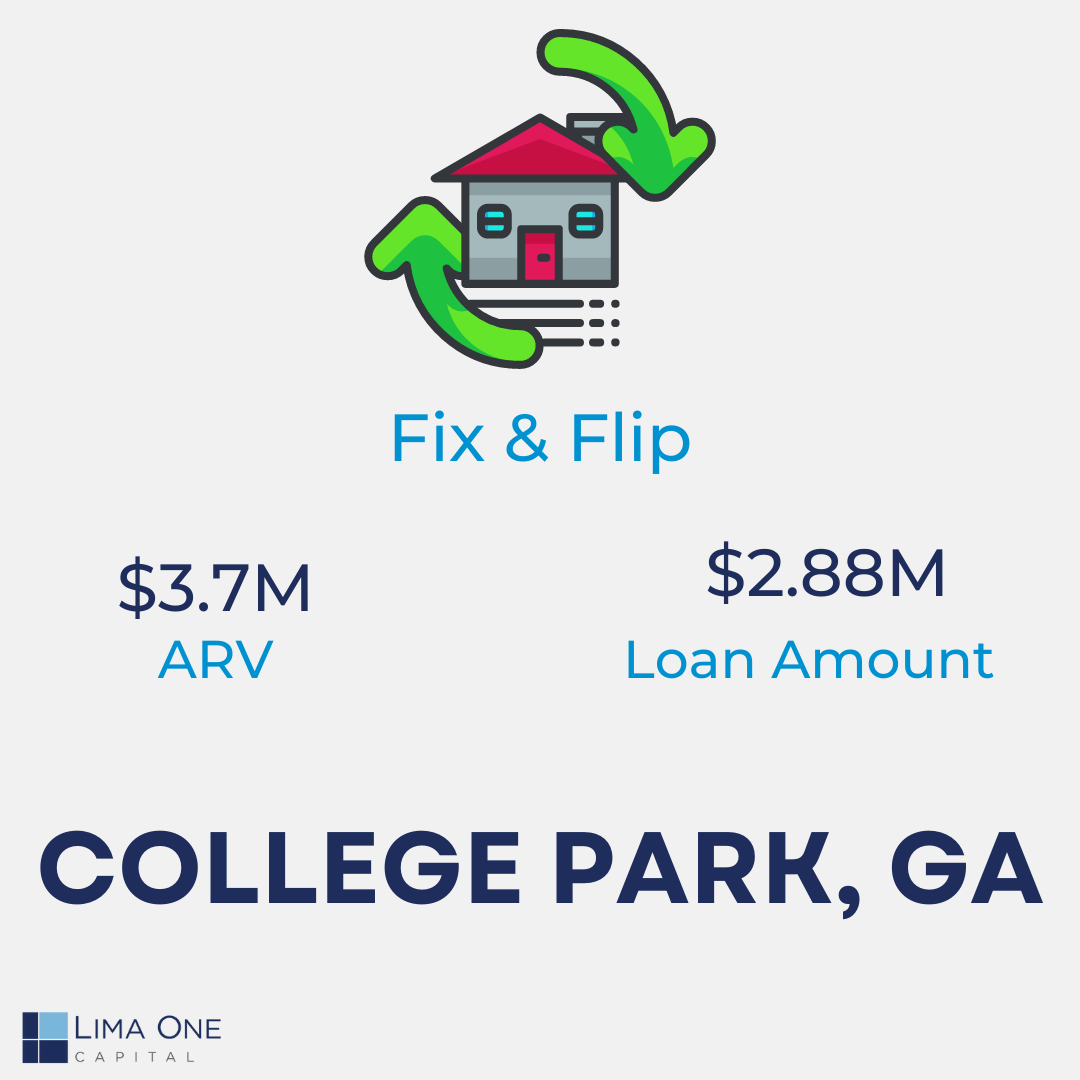

Lima One Capital has the best fix and flip loan options among private lenders for investors looking for a rehab loan for an investment property, with the option to easily and affordably transition the flip to a rental property with a rental loan.

As experienced hard money lenders, we’re able to move quickly when you find the right opportunity to invest in a fix and flip property. We understand that our clients have a wide range of investment strategies, so we have designed our fix and flip loan options to allow us to cater to their individualized needs.

Regardless of your investment strategy, we’re here to help. Contact us today to discuss your next deal, or if you have a deal in hand, you can speed up the process by applying now.

Recent Comments