Building Rental Properties in Chicago is a Sure Bet

Chicago has given us several reasons to fall in love with the city – deep-dish pizza, the epic Bulls dynasty of the 1990s, Harry Caray’s rendition of “Take Me Out to the Ball Game,” and the architectural designs of Frank Lloyd Wright.

Despite the challenges brought on by 2020, the Windy City’s real estate market is making investors take notice.

The Chicago real estate market is strengthening in both the city and the suburbs. The Chicago Sun-Times reports that demand for housing in suburban Chicago is strong and the city’s neighborhoods appear to be catching up.

Quick Facts on Chicago’s Current Real Estate Market

-

- Inventory is down to historically low levels, pushing the price of a home higher year over year.

- Median home prices in Chicagoland have increased by more than 14% throughout the nine-county region.

- Single-family permits have increased, while multifamily permits have decreased dramatically. This indicates that many Chicago area residents want single-family living in less dense suburban areas, mirroring a national trend.

- Chicago area home sales prices are soaring for the first time in years as the economy rebounds from the pandemic.

- According to The Real Deal, the volume of sales transactions has increased by nearly 20% YOY as people look for more space.

Chicago’s recovery and real estate demand have the city primed to do well as investors seek opportunities in new home construction, build to rent homes, and single-family rentals.

The State of Chicago’s Rental Market

1. Rental Vacancies Are Up, Rent Prices Are Down

Rent prices and occupancy both dropped considerably in Chicago. Rental occupancy is currently on the verge of being below the “good” range – currently at 91.5%, down from 94.2% in 2020 – and rent prices in Chicago dropped an average of 2.7%.

Chicago, IL mirrors the national trend of large cities with increased rental vacancies. Several major cities across the nation, especially those with high costs of living, experienced an urban exodus from urban cities toward the suburbs that was fueled by the shift to working remotely.

2. Unemployment Rates Are Still High

A national study ranked Chicago’s unemployment recovery 172nd out of the 180 most-populous U.S. cities. Currently, Chicago’s unemployment rate is 7.1%, while the national unemployment rate is 5.8%.

While the City of Chicago’s rate is consistently falling, investors should be aware of the unemployment rate and a renters’ ability to pay, which could lead to problems keeping up with the landlord’s mortgage – especially as the national eviction moratorium expires.

3. Inventory Is Low, But New Construction Is Growing

Chicago currently has only 1.4 months’ worth of housing inventory, which has caused home prices to skyrocket. Tight inventory may be a short-lived issue, however, because new construction homes and communities are on the rise and the number of SFR permits has increased. These in-progress projects and pending new construction starts will help to ease the inventory shortage Chicago, Illinois is currently seeing.

As inventory supply increases, housing demand is expected to continue to increase – especially SFR housing (single-family residential) – and housing prices are expected to increase by 6.9% for the rest of the year.

Investors looking for real estate investment opportunities will find the most success by building rental properties in Chicago. Enter build to rent, one of the fastest-growing trends in the real estate rental market.

Why Invest in Build to Rent?

Nationally, build to rent single-family properties have increased 27% from 2019 to 2020. Before the pandemic, the build to rent strategy was already booming. Post-COVID-19, the demand for rental properties in Chicago and across the nation is even higher.

Initially, the build to rent investing trend was typically seen in the form of small multifamily properties such as duplexes and triplexes. Now, the concept of building properties to rent is being used for single-family homes to capitalize on the booming rental market.

Build to rent properties often come with upgraded features like smart keypad locks, wireless technology in the home, and upgraded appliances. These rental properties offer renters the benefits of living in a single-family home without the burden of HOA costs or servicing mortgage debt.

Real estate investors typically have very low maintenance costs for the first several years on new rental homes built, which helps to improve their passive income and net cash flow. Build to rent properties also tend to rent at a higher rate than older homes.

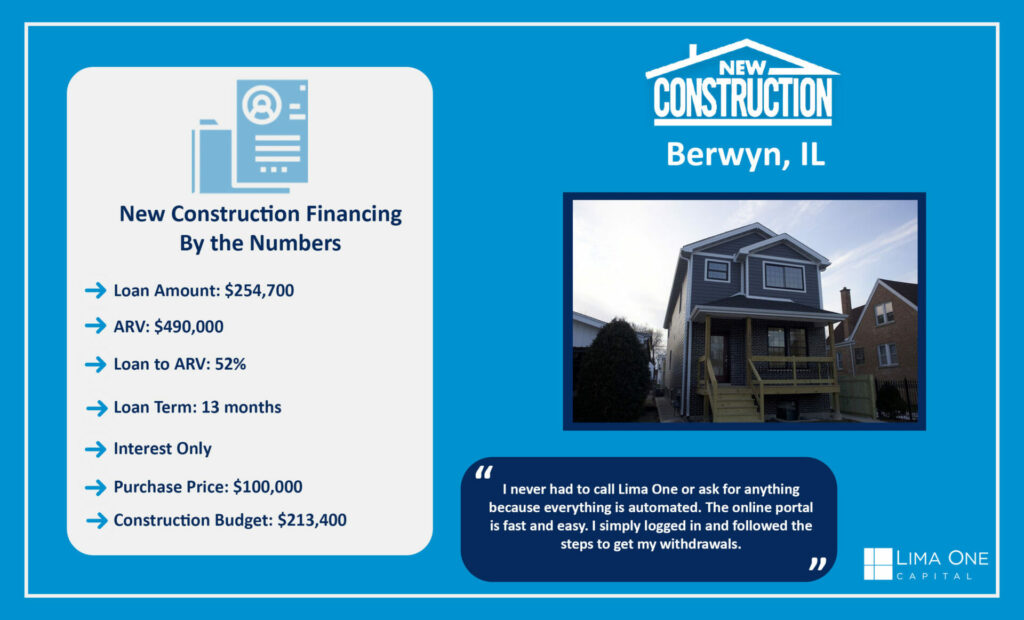

Plus, with new home construction loan financing and rates on rental property loans at all-time lows, the value proposition on build to rent investments is too attractive when compared with other types of investments. Real estate investors can find both a loan to build rental property and long-term rental loans for investment properties in Chicago, IL from Lima One Capital.

Chicago’s Build to Rent Market

Investors are building tens of thousands of houses expressly to rent, hoping that the population will continue opting for spaces larger than apartments if they can’t afford to buy homes.

COVID-19 sparked a race for space among Americans. The idea of living in an expensive-yet-small apartment that also served as an office, workout space, and school was no longer appealing, as many renters across the country exchanged high-rise living with single-family homes. Additionally, work from home trends rendered longer commutes from city centers to the suburbs a moot issue.

The exodus from urban cities and downtown areas allowed many builders in secondary markets or suburbs to boom in 2020. Chicago has been no exception.

As home prices have risen, the demand for single-family rental housing has also risen– creating an opportunity for real estate investors to turn to build to rent housing with a focus on SFR properties. Chicago single-family permits increased from 7,082 permits in 2019 to 7,392 permits in 2020, while multifamily permits decreased 27% YOY.

The large population of renters in the area means that rental income for properties in Chicago is far better when compared to many other cities in the country.

The Institute for Housing Studies at DePaul University found that the number of rental households among those earning at least $132,000 a year nearly doubled in the past year. In addition, those earning $80,000 to $132,000 annually saw the number of those renting households increase by just over 50%.

Rising home prices in Chicago are likely one reason why more people in the Chicagoland area choose to rent rather than buy. Investing in rental property in Chicago could be a smart move this year for local and remote real estate investors, with a strong pool of renters waiting for finished builds.

What Does This Mean for Investors?

Chicago has become the center of attention for real estate investors. It has the optimal cost of living, high tenant retention, consistent growth, and above-average median home prices. With more rental properties being listed, there are more opportunities for real estate investing in Chicago.

Although there are fewer multifamily opportunities at this moment, Chicago continues to see a surge of single-family rental properties in populated suburban areas such as Naperville, Buffalo Grove, Claredon Hills and more.

As an investment option, Chicago has a lot to offer. Specifically, price points are lower, which means investors will see their money go further than it might in another city. While the Windy City has not fully recovered from the effects of the pandemic, experts believe a full recovery is inevitable.

While inventory might be harder to find, investors with strong real estate investment strategies can still profit. It’s now more important than ever to have a lender capable of helping you:

- Secure a loan with the best price and maximum leverage for your next rental investment

- Close properties quickly and certainly

- Run your construction and rehab projects smoothly

If you’re interested in obtaining construction loans in Illinois, contact us to learn more. We are experts in financing new home construction for builders on urban in-fill, spec homes, model homes, and teardown/rebuild projects. Our team of experienced professionals will help guide you through getting a new construction loan for your investment property in Chicago.

Get started today and scale your rental property portfolio with Lima One, the nation’s premier lender for real estate investors.

Recent Comments