Maximizing Returns & Growing Portfolios Using Leverage

The housing market has been on fire the past two years. We’ve seen historic home growth, homes selling as soon as they’re listed, and sale prices that far exceed asking price.

Halfway through 2022, the market changed, which has created a drastically different housing market for homebuyers and real estate investors. Interest rates have skyrocketed, which has stifled home price appreciation, and intensified investors’ need for leverage to scale their portfolios and maximize their profits.

The idea behind leveraging real estate to build wealth is using other people’s money to increase returns, which keeps investors from having to put a lot of their personal capital into buying a property.

How Leverage Works

Leverage allows real estate investors to put less of their money into one deal so they can do multiple deals that increase their overall profits and return on investment, while also building their real estate investment portfolio.

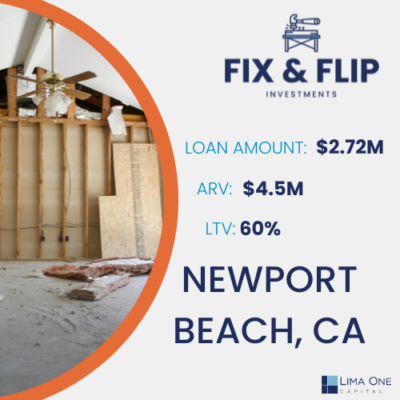

Fix and flip investments are a great example of how to leverage real estate. Over the past few years, people have become fascinated with fix and flip shows on HGTV. They love watching seasoned real estate investors take a run-down, distressed property and, after a few dramatic unexpected twists and turns and a lot of value-add rehab, turn it into an unrecognizable, beautiful home all while bringing home a nice profit. These individuals and many more like them realize the ROI potential on a fix and flip property.

The question on many people’s minds is: how they have the money to do all of these deals?

The answer to that question is simple: leverage. Leveraging capital empowers investors to do more deals and spend less of their own money out of pocket. Having fewer out-of-pocket costs also increases the investor’s bottom line and allows them to bring in higher profits on these investment properties.

Here’s an example of how leverage works:

Investor A wants to invest in a fix and flip property and renovate a house. The purchase price is $150,000, and they need $50,000 to rehab the property. Investor A doesn’t use any leverage and puts up their own money.

When the rehab is complete, Investor A sells the house for $350,000. After putting $200,000 of their own money into the flip, Investor A’s ROI on the fix and flip property (after real estate and closing fees) is a little under $150,000.

Investor B uses money from a private lender or a hard money loan and only puts down 10% of the purchase price and rehab on this same fix and flip investment, so they end up only paying $20,000 of their own money to fund the deal. They also resell the home for $350,000. After paying back their loan to their hard money lender or private lender ($180,000) plus interest and realtor fees, their ROI on the fix and flip investment is around $170,000.

Since Investor B capitalized on leverage real estate and only had to put down 10%, they can also finance and work on other properties at the same time.

The same principle works when building single-family rental portfolios. Instead of holding properties with lots of equity, investors can leverage their real estate investments by getting loans on properties that give them cash for the equity so they can buy more properties. Using a cash-out refi loan in this way is a great way to come up with the capital needed for investing in real estate. Through a cash-out refi, investors and would-be investors can access the equity in their properties and turn that into cash for additional investments.

Leverage and Home Price Appreciation (HPA)

Before investors weave leverage into their investment strategy, it’s important to note the unusual growth of home price appreciation over the past two years and how it affects investments based on leverage.

From 2013 to 2020, home price appreciation grew from roughly 5 to 7% annually. But over the past two years, 2020 to 2022, prices grew by 17.7% each year.

Let’s put this in real-world terms. An average home priced at $300,000 in 2020 would have appreciated $53,000 in 2021 and $62,000 in 2022—a total gain of $115,000 in two years.

Instead of growing from $300,000 to $337,000 over 24 months at a historic 6% yearly rate, it grew from $300,000 to $415,000. That’s a massive difference – one that gave investors and homeowners much more equity in properties in a short period of time.

The most recent numbers from summer of 2022 show that prices peaked around June, with slight declines – less than 1% – in subsequent months. This indicates that the period of massive home price appreciation is over, and we have entered a new environment. But anyone asking if the housing market is heading toward another crash needs only look at the increased equity across the market to see that mass foreclosures are highly unlikely

So what does this mean for investors wondering if this is a good time to leverage real estate? In short, using leverage is still a solid strategy. In fact, with many regular home buyers taking a seat on the sidelines due to the high 6% interest rates, investors don’t have as much competition in the home buying arena as they did a year ago.

Since HPA is flat – and declining slightly in some areas – investors still have the opportunity to leverage the equity they have gained on properties in the past two years. And with a less frenetic buying environment, investors can take advantage of the market and grab properties they would’ve missed out on a year ago because sellers who are motivated to sell to capture their newfound equity won’t have as many buyers beating down their door.

What Should Investors Expect with Leverage Real Estate?

The first half of 2022 gave us mortgage rates that have steadily climbed in response to the historically high inflation rates we’ve also experienced. Experts predict that rates will continue to climb at a modest pace in the last few months of 2022.

Going forward, home price appreciation is expected to flatten or even tick down, but current projections still expect that properties will hold the vast majority of their equity gains over the next 12 months.

As an investor, what are you going to do with this equity? And what lender will you work with to help you leverage the equity with the right combination of price, speed, and service?

Not all private lenders are the same, so it’s important to find one that has your investment goals and strategies in mind during the lending process. Lima One Capital has multiple loan options designed to help investors build their portfolios using leverage.

With our fix and flip loan, we can cover up to 90% of the cost of the property plus rehab with a term length of 13, 19, or 24 months. These interest-only hard money loans are ideal ways to leverage real estate and minimize out-of-pocket costs during the rehab period.

Our bridge loans allow us to cover up to 80% of the purchase price and rehab costs with term lengths of 13, 19, and 24 months to purchase or leverage properties that need no rehab. These hard money loans provide a great interest-only solution for investors hoping to wait out the current rising interest rate environment.

Our clients have different investment strategies, so we have designed a full suite loan options to allow us to cater to their individualized needs—whether flips, bridge loans, or rental loans for long-term holds. Contact us today to discuss your next deal, or if you have a deal in hand, accelerate the process by applying now.

Recent Comments